● 5 People behind its cancellation named

STORY BY:

MOSES MUGALULA

KAMPALA

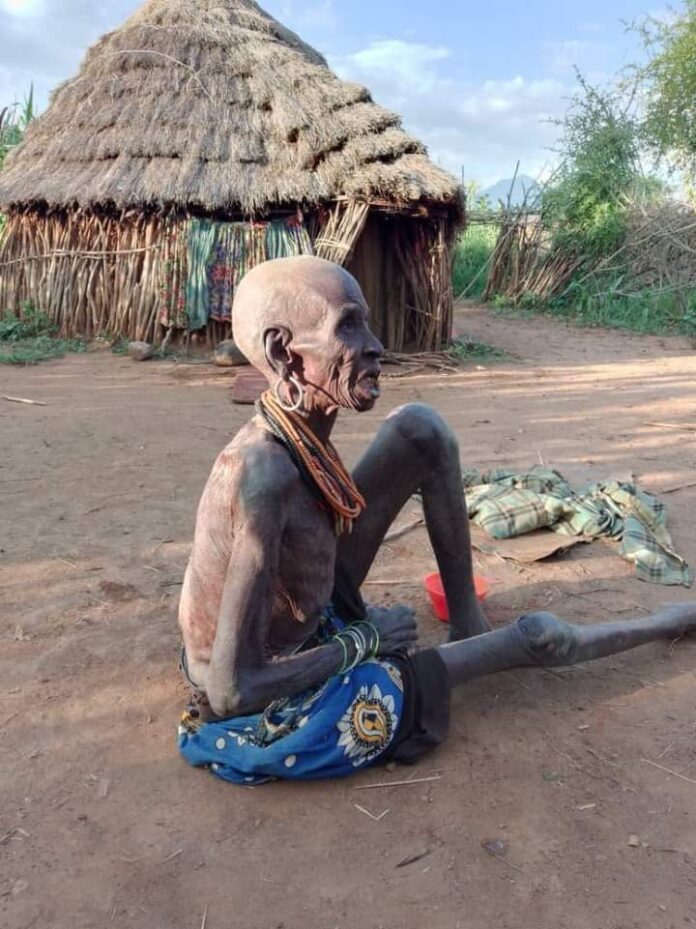

VENDORS of St. Balikuddembe market commonly known as Owino led by their Chairperson Ms. Suzan Kushaba are in jubilations following cancellation of the three land titles which were registered in the nanes of SSLOA, a company run by former chairman Godfrey Nkajja Kayongo.

SSLOA stands for St. Balikuddembe Market Stalls, Space and Lockup Shops Owners Association.

Mr. Kayongo was among market leaders fired on directives of the Head of State Yoweri Kaguta Museveni for milking low income earners in markets.

Speaking to this fastest growing news website, Madam Suzan Kushaba congratulated fellow vendors saying, their market land has been reclaimed and in safe hands.

When President Museveni met ‘his daughter’ Suzan Kushaba, chairperson Owino Market

Thanking the Almighty God who made it possible for Owino vendors to get back their land, Ms. Kushaba said, “The battle that has been raging on to get back our market land is now over. The three land titles formerly under SSLOA have been cancelled and transferred to KCCA management. We want to thank His Excellency the President for his able leadership, full support and guidance. As Owino market traders, we are very much proud of you Mr. President.”

FIRED: Godfrey Kayongo

Kushaba named other people who fought on the side of Owino market vendors in order for Kayongo’s titles to be cancelled.

Calling them Ugandan Patriots who saw that low income earners get justice and enjoy the benefits of the current government, Suzan Kushaba named the following people;

DOROTHY KISAKA

She is The Executive Director Kampala Capital City Authority (KCCA). Kushaba said, Madam ED who she branded an iron lady laboured to make sure Kampala markets gain and benefit from all government programs. Her efforts were also geared at making sure SSLOA titles are cancelled so that Authority takes control of this market to benefit all.

DAVID BALONDEMU

A lawyer by profession, Counsel Balondemu is Chairman Kampala Land Board. Kushaba says, Balondemu is none of a few Ugandans who believe and practice, intergrity, equality and justice for all.

MAJOR EMMA KUTESA

His endless calls to who ever blocked vendors’ way, Kushaba says earned them victory.

PROPHET SAMUEL KAKANDE

He is The Synagogue Church of all Nations founder. He gave Suzan Kushaba a prophecy on May, 3rd 2009. Since, he has been playing endlessly praying for vendors to get back tneir land.

For views/remarks on this story, WhatsApp our editor on 0772523039