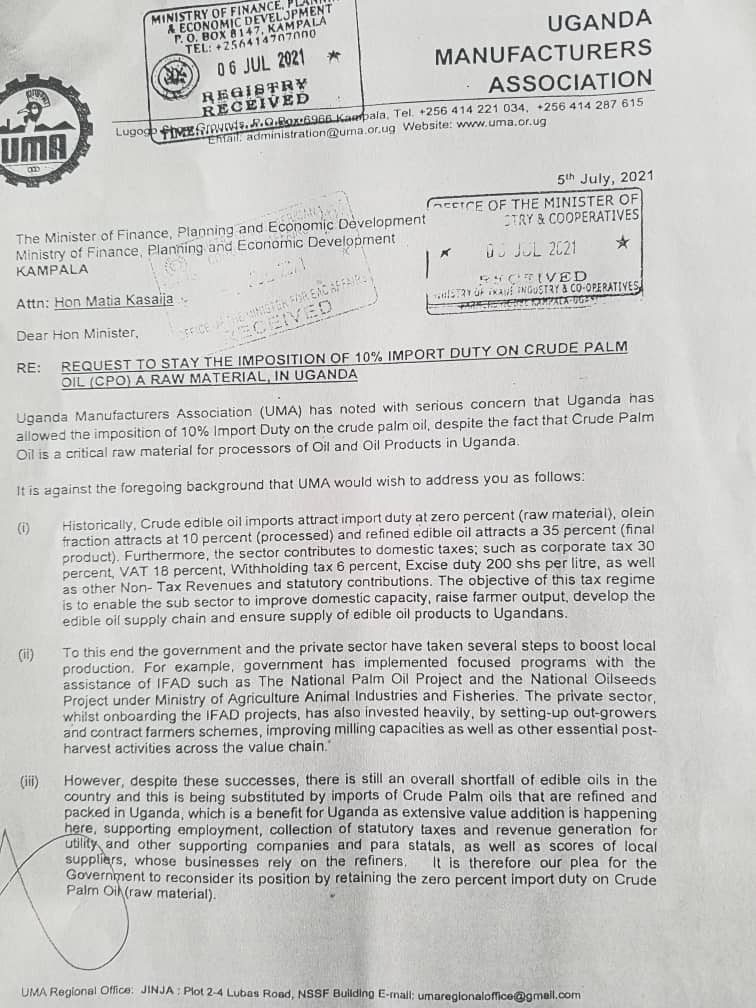

PHOTO: This cooking oil is made from Kenya and sold in Ugandan markets. Its manufacturers compete with Ugandan manufacturers who are subjected to excise duty per litter of produced cooking oil.

NEWS EDITOR MEDIA

newseditor.info@gmail.com

THE 10% CPO Tax has Hit Oil Sector in Uganda as ‘Tax Free/Illegal Products’ Flood Ugandan Market.

In July 2021, Government of Uganda levied UGX 200 on a litre of Cooking Oil and the 10% import duty on Crude Palm Oil products even when Crude Palm Oil is an essential raw material for sector players of Oil and Oil Products in the country.

As a result of these levies, there is abnormally a current increase in prices of personal care items, edible oils and cleaning products. The affected sector belongs to the Fast Moving Consumer Goods category.

The Ugandan Manufacturers who have been subjected to the excise duty per litre of produced oil must compete for cereals with other East African counterparts who don’t have such tax in their countries. Important to note is that the Ugandan market prefers palm oil products to sunflower products.

Surprisingly, Uganda is a key member of the East African Community that agitates for zero taxes on such products yet the cost of production in other East African states is said to be cheaper compared to Uganda’s. Unless it’s repealed, it will slowly discourage sector players making it inevitable for the different investors/cooking oil factories to close down, move to any East African States. This in both short and long run will lead to loss of jobs by many Ugandans, URA will not get taxes and Uganda’s supply chain will be no more.

Crude Palm Oil prices hit record high in May 2021 along with Soya bean oil, Sunflower oil and other soft oils which compete for a share in the vegetable oil market. The prices in Uganda have increased to USD1500 (UgX5.4m) per metric tonnes from USD500 (ugX1.8m) close to two years ago.

One Kilogram of such products was at UgX4500 last year from UgX3500 over the last three years thereby tampering with the prices of several household items in modern times.

For example soap which for long had been sold at UgX4000 is currently being sold at UgX4500 at known sales points throughout the country with a litre of cooking oil increasing from UgX7000 to UgX10,000. The price changes have not spared margarine and other edible oils whose costing has shot up by over ugX3000.

A key sector player on condition of anonymity notes that with the persistent lockdown and restrictions brought by the COVID-19 pandemic, shipping lines are hardly available and those that exist have increased charges by abnormal percentages never heard of adding that the increase is visible in other raw materials used in the production of the products. As a result, this makes transportation costly and drives the cost of production through the ceiling especially now that the government introduced a 10 percent import levy on raw material as a measure for import substitution.

Research shows that currently, available sector players can produce between 3000-4000 metric tonnes compared to the local demand which stands at 15,000 metric tonnes. This means that with the current crisis in the sector, cereal oils like sunflower and soybean would have been a good substitute. However, their production remains at the lowest.

Having observed the unfair treatment some of their members are being subjected to compelled Uganda Manufacturers Association through their outgoing Chairperson, Barbra Mulwana to write to the Minister of Finance, Planning and Economic Development.

In her July 5, 2021 letter, workaholic Mulwana revealed that their association had noted with serious concern that Uganda had allowed the imposition of 10% Import Duty on the crude palm oil yet historically, Crude edible oil imports attract import duty at 0% (raw material), olein fraction attracts a 10% (processed) and refined edible oil attracts a 35% (final product). She further says that the sector contributes to domestic taxes such as corporate tax 30%, VAT 18%, withholding tax 6%, Excise duty UgX200 per litre as well as other Non- Tax Revenues and statutory contributions. She also argues that the objective of this tax regime is to enable the sub sector to improve domestic capacity, raise farmer output, develop the edible oil supply chain and ensure supply of edible oil products to Ugandans.

Noting that government and the private sector have taken several steps to boost local production citing an example where government implemented focused programs with the assistance of I FAD such as The National Palm Oil Project and the National Oilseeds Project under Ministry of Agriculture Animal Industries and Fisheries, the private sector whilst onboarding the I FAD projects, has also Invested heavily by setting-up out-growers and contract farmers schemes, improving milling capacities as well as other essential post-harvest activities across the value chain.

Mulwana who has since ceased the chairperson of manufacturers in the country asserts that despite these successes, there is still an overall shortfall of edible oils in the country and this Is being substituted by imports of Crude Palm oils that are refined and packed in Uganda, which is a benefit for Uganda as extensive value addition is happening here supporting employment, collection of statutory taxes and revenue generation for utility and supporting companies and parastatals as well as scores of local suppliers whose businesses rely on the refiners. She has since pleaded with government to reconsider its position by retaining the zero percent import duty on

crude palms oil (raw materials).

The experienced Mulwana as far as business is concerned anticipates challenges as a7 result of the implementation of the 10% Import Duty on Crude Palm Oil (raw material) to include but not limited to partner states for example Kenya charging a 0% import duty on Crude Palm Oil, an increase of Uganda’s imports duty from 0% to 10% will lead to dumping and smuggling of Kenyan products (refined edible oils, cooking fats and soaps, made from the non-taxed CPO) by traders on to the Ugandan market.It’s important to note that a similar scenario has been experienced in the wheat sub sector and has resulted into massive wheat smuggling along the country’s Eastern border, the introduction of a 10% import duty on Crude Palm Oil (raw material) is affecting prices of edible oil products as well as byproducts such as soap used as a key product in the fight against COVID19,Distortion of the import substitution effort, introduction of a 10% import duty on Crude Palm Oil (raw material) will encourage local edible oil refiners to import already processed oleim fractions (refined clean processed from CPO which is the raw material) instead of raw materials (CPO) Leading to value addition happening outside Uganda as opposed to within the country. This will lead to a policy failure with regard to the government industrialization agenda,the operating cost for oil millers have been on the rise, for example the cost of labour is increasing due to growing demand for welfare benefits such as medical, insurance benefits in the event of (accident, disability, death, retirement), leave as well as salary increments, Local oil production from locally sourced oilseed grain is at approximately 150.000 to 180.000 metric tons per annum which has significantly increased over the years but still low to meet domestic demand of approximately 220.000 to 240.000 metric tons per annum. On the other-hand oil seed grain used in production of edible oil such as soya bean and sim sim are consumed as direct food, leaving a smaller portion for oil milling. As a result, making Uganda a net importer of edible oil,the edible oil sub sector is strategic to Uganda’s economy, it offers livelihood to a number of players involved in the value chain i.e. transporters, millers, plastic, carton and label manufacturers, distributors, importers/exporters, clearing agents, wholesalers, hoteliers/restaurants, confectioneries, advertisers among others not to mention. These not only pay central government taxes, they also remit statutory payments such as licenses and fees. NSSF. Utilities etc. At the backdrop of the prevailing COVID19. increasing import duty from (0 to 10) % will negatively affect the value chain with anticipated losses in consumption and income to many who depend on this value chain, production of edible oil is constrained by a number of factors such as small-scale and fragmented land holdings, limited adaptation to weather changes, leading to low yields, prevalence of diseases and pests, low survival rates of seedlings planted, low use of agro-inputs, poor farm management and limited use of market-oriented production such as contract farming, high cost and limited availability of inputs (improved seeds, fertilizer and chemicals). This shows that the sub sector needs more support from government, across oil seed milling firms, capacity utilization is a problem. This is caused by the meager quantities of oil seeds grain on the local market. Additionally, climate change and fluctuations in rain patterns h3ve negatively affected the yield per hectare. Therefore, staying the import duty at zero percent will allow full implementation of the MAAIF/IFAD programs and consequently enabling the import substitution in the sector, More land is needed to produce edible oil. For example, with the current imports of 244,985.7 tons of edible oil Uganda would need either 65.844.9 hectares (162.706.2 acres) of oil palm. However, it should be noted that land is also needed to produce other food crops if Uganda is to maintain food security.

With an elaborative explanation, Uganda Manufacturers Association appeals to government to stay the application of the 0% Import duty on crude palm oil as this will help minimize the edible oil sub sector trade deficit in the short run as a long-term solution is realized at 0% import duty, the edible oil sector will remain competitive in comparison to EAC partner states and for related exports markets, through the Ministry of Agriculture, Government should push for the increase In edible oil yield per hectare by Incentivizing supply of agro-imago puts e.. Improved climate resistant seeds, familiar pesticides and market-oriented farm practices such as contract forming and out growers, government should lobby EAC Governments to have a harmonized position at the EAC level, Government should consider banning the exports of unprocessed oil seeds and oil palm. Or impose punitive export tariffs, in line with international best practices. This will naturally trigger local processing with all the attendant benefits in form of employment creation, value and monetization of the local economy

For views/comments on this story, WhatsApp editor on 0772 523 039