PHOTO: NSSF Ag. MD Patrick Ayota addressing media today morning. (Photos from NSSF)

STORY BY

MOSES MUGALULA

newseditor.info@gmail.com

ACTING Managing Director National Social Security Fund (NSSF) Mr. Patrick Ayota has assured members of the fund that their savings are very safe asking them to ignore baseless allegations circulated by people with ill intentions! He said, the test against a lie is time and the test against truth is also time.

“The state of the fund is fine, business is sounding, benefits are being paid each and every other day, politicians have no access to your funds. We dont keep your money in cash, it is invested, your money is in Bank.” Noted Mr. Ayota

The national Social Security Fund Uganda is a multi-trillion Fund mandated by Government through the NSSF Act, as amended, to provide social security services to employees in the private sector.

The Fund is a secure, innovative and dynamic social security provider that guarantees safety, security and a competitive return on members’ savings of over 2% above the 10-year inflation average.

The Fund manages assets worth over UGX 17.8 trillion, invested in Fixed income, Equities and Real Estate assets within East Africa region. As the largest fund in the East Africa by value, NSSF has the ambitious goal of growing its Assets Under Management to 20 trillion by 2025.

The Fund is regulated by the Uganda Retirement Benefits Regulatory Authority while the Minister of Gender, Labour and Social Development , and the Minister of Finance, Planning and Economic Development are responsible for policy oversight.

‘NO ONE CAN TOUCH YOUR MONEY’ – Ag. MD AYOTA

Addresssing Media at Workers House in Kampala today morning about the state of NSSF and the Fund’s half-year performance, MD Ayota said NSSF is on track to achieve its key performance targets for the Financial Year 2022/2023 after its contributions, collections and realized income grew by 22% and 17% respectively for half year as at the end of December 2022. He vowed that no one, be it who can touch savers money, members of the fund should ignore the allegations making rounds on social media.

Mr. Ayota was franked by Ms. Barbra Arimi, the Head Marketing and Communications, Mr. Victor Karamagi, Senior Manager, Public relations and Ms. Shaton Nabweteme the Public Relations officer.

“Half year contributions collected by the Fund topped UGX 786Bn, compared to UGX 643Bn over the same period last Financial Year. Realized income also topped UGX 1.054 trillion in December 2022 from UGX 900Bn over the same period last Financial Year, driven by higher interest rates on Fixed income investments.” Revealed Ag. MD Ayota.

The Fund registered 2,078 employers and 67,277 controbutors respectively over the last 6 months.

Records show, the Fund Asset size also increased from UGX 17.65 trillion in July 2022 to UGX 17.88 trillion in December 2022. Although the rate growth reduced compared to the same period last Financial Year, Mr. Ayota said the reduction is attributed to increased benefits payout.

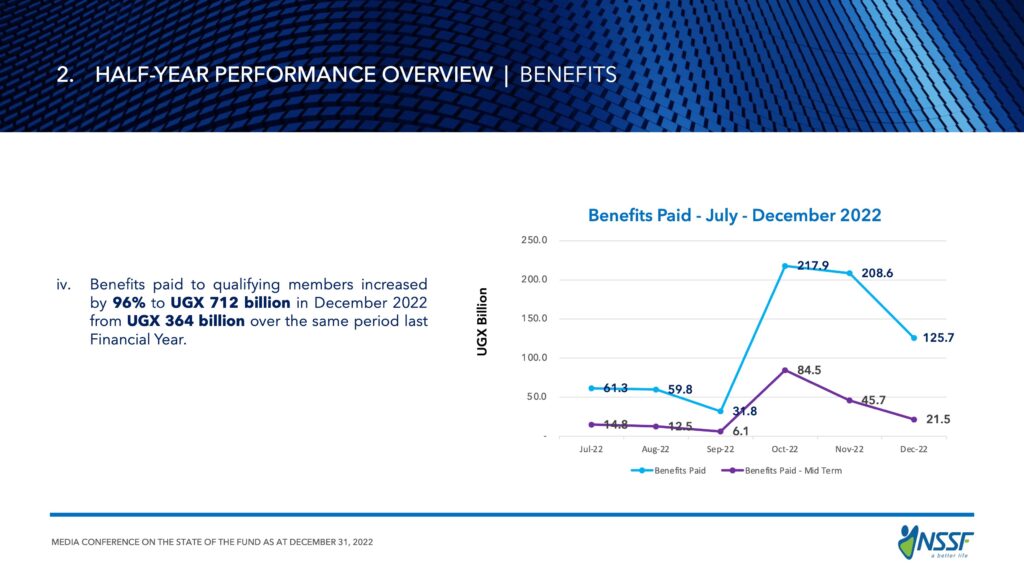

This leading investigative news website have information showing how NSSF paid UGX 712Bn over 6 months in December 2022 compared to UGX 364Bn over the same period in the previous Financial Year.

MD Ayota noted that, “The increase in benefits payments does not suprise us because this is the trend in the first half of the year because qualifying beneficiaries tend to wait for interest rate declarationat the end of September every year before they submit benefit claims. That is why, in the month of October and November following interest declaration, we paid UGX 217.9Bn and UGX 208.6Bn respectively.”

Commenting on the planned initiatives to recruit savers from small and Mediam Enterprises (SME) and informal sectors, Ayota said that the Fund is ready to fulfil its mandate following presidential assent to the National Social Security Fund (Ammended Act) 2022.

He said that the Fund will roll out a recruitment plan after issuance of the Regulations by the minister of Gender, Labour and Social Development.

“Our plan revolves around two strategic pillars; Creating the capacity of Ugandans to save and creating a willingness by Ugandans to save. That will enable us to achieve the overriding national goal of expanding coverage of basic social security in Uganda from 1.3M members with balances in NSSF to 15M Ugandans by 2035. A capacity to save will also tackle the strategic challenge of ensuring compliance with the NSSF Act as amended.” Mr. Ayota told journalists.

Asked whether he wants to be appointed MD NSSF, Ayota was postive. ” Yes i want to be the MD but i dont guarantee whether i will be. My responsibility is for today, tomorrow it might be a different story.” Replied Ayota who journalists saluted for being a very sharp leader.

About NSSF bosses meeting Gen. Saleh and what was the discussion about, Mr. Ayota said he didnt attend the meeting because he wasnt invited. “So i can’t speculate on what transpired in the meeting. However on whether it was fine for NSSF to meet Gen. Saleh, Ayota said that was ok.”

“NSSF works like any other Financial institution. You can not enter any bank and get money without relevant documents. Savers money here is tracked.” Ms. Arimi nailed it.

For views/comments on this story, Whatsapp editor on 0772523039